Published 10th March 2023

The earliest recorded history of “infrastructure” dates back to the early 1700s, during and through the Agricultural Revolution. During that era, society and community settlements evolved and developed their farming methods, leading to increased crop production. Consequently, the need for consistent path routes for inter-community trading purposes arose.

Early infrastructure roads then ‘naturally’ developed from well-used and travelled human and animal paths from one settlement to the other. These paths became navigation tools and became increasingly important over time – creating a network of ‘desirable’ paths and roads.

The word “infrastructure” was coined as a term in the late 1800s with Latin heritage comprising “infra” as a pre-fix meaning below or underneath, whilst “structure” has referred to building or foundation.

The word “infrastructure” was coined as a term in the late 1800s with Latin heritage comprising “infra” as a pre-fix meaning below or underneath, whilst “structure” has referred to building or foundation.

Both taken together, “infrastructure” in an economic sense, carried the definition of a foundation on which the structure of an economy was built and developed. Without such a foundational platform, modernized and industrialized life would not have taken shape to where it is in our world today.

Infrastructure is therefore often referred to as the physical, economic, and social systems providing support to society in regions, countries and globally.

What is infrastructure in modern society?

Today, infrastructure comprises of a variety of systems, platform and structures which require physical assets and components (such as the electrical grids, pipelines, roads and bridges) across cities, states, and even countries. Infrastructure is essential to societies and economies around the world, as it enables connections and the provision of specialized services in an increasingly complex societal and economic system.

Infrastructure is generally characterized into the following:

- Hard infrastructure – physical assets and components that support basic essential services for the economy and provide daily quality of life. These assets include electric grids and pipelines, highways, roads and bridges, water and sewerage, as well as transportation such as trains, mass transit and buses.

- Soft infrastructure – this refers to social and economic institutions such as healthcare, education, network platforms, financial institutions, legal systems etc.

Infrastructure projects and investments tend to be capital-intensive, but they are vital to a region's or country’s economic development and prosperity. Hence, projects related to infrastructure and its improvements often benefit from public or government support and funding, or alternatively, undertaken through public-private partnership arrangements as well.

Key takeaways

- Infrastructure relates to basic systems or facilities serving a country, region, or its community.

- Infrastructure: classified as either hard or soft and both are essential to the economy and society’s quality of life.

- Large-scale infrastructure is typically driven by the public sector initiatives and supported by the government or government agencies.

Types of Infrastructure Investments1

Infrastructure investments can be segregated on the basis of its underlying assets, such as:

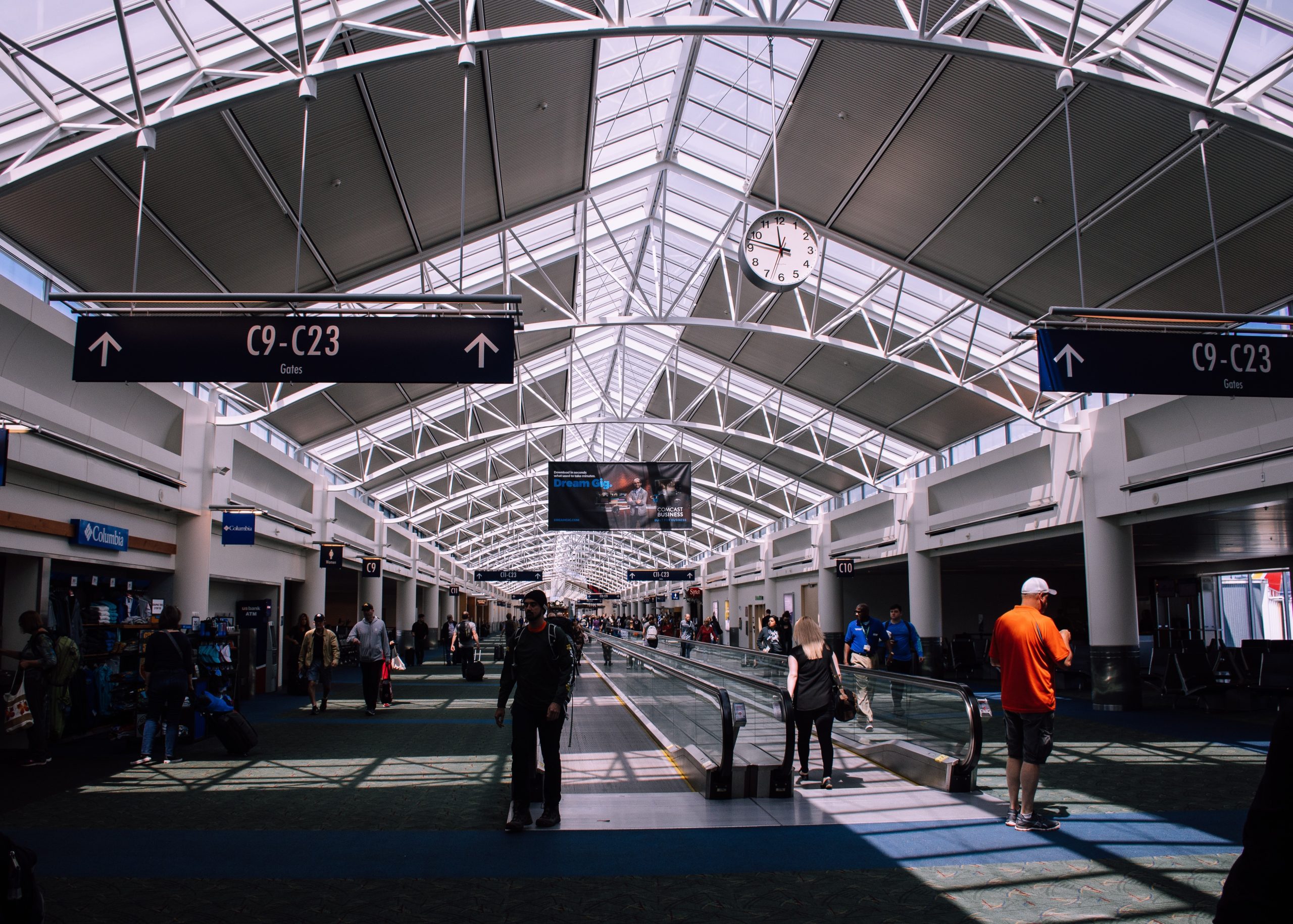

- Transportation assets include roads, bridges, tunnels, airports, seaports, and urban railway systems. generated from transportation assets are usually linked to demand based on traffic, port charges, tolls, and rail fares and hence, deemed to carry market risk.

- ICT assets include infrastructure that stores, broadcasts, and transmits information or data, such as telecommunication towers and data centers.

- Utility assets generate power and produce potable water; they transmit, store, and distribute power, gas, water, and electricity; and they treat solid waste.

- Power and energy assets produce, store, transmit and distribute energies. Power and energy assets increasingly encompass environmentally sustainable development, with a greater focus on renewable technologies, including solar, wind, and waste-to-energy power generation. Other energy assets may encompass mid- and downstream oil and gas infrastructure, such as pipelines and liquefied natural gas (LNG) terminals. Such power and energy assets can institute “take-or-pay” arrangements locking customers into minimum purchases whether supply is needed or not.

- Social infrastructure assets are directed towards human activities and include assets such as educational, healthcare and social housing, with the focus on providing, operating, and maintaining the “shell-and-core” of the asset infrastructure. The relevant services administered through these facilities, be they medical or schooling, are typically provided separately by a contracted service provider. The revenue generated from social infrastructure is typically derived from lease payments that could depend on availability payments and on managing and maintaining the asset according to pre-agreed standards.

What are their characteristics?

While there are several types of infrastructure assets, they share fairly common characteristic and traits that makes them a distinctive asset class.

- Long lifespan : Although maintenance and repair are necessary, infrastructure assets are generally engineered to have a long lifespan and can provide dependable service for many years, even decades.

- Strategic importance : Infrastructure assets play a crucial role in the operation of societies and economies, and their positive impact extends beyond their immediate users to benefit the larger society. This demonstrates their positive externalities. For instance, a bridge not only creates employment opportunities during its construction phase, but also provides benefits to the drivers who utilize it and the local economy and environment. Moreover, the long lifespan of such assets and their potential to make a lasting impact over many years further amplifies their effect.

- Regulated : Because of their significance, infrastructure assets are commonly regulated to guarantee their provision of dependable and reasonably priced services, while also safeguarding other factors like public health and safety. Such regulations may typically comprise quality and safety standards, as well as environmental and social standards.

- Significant capital investment : Infrastructure projects are typically capital-intensive, meaning they require sizeable upfront capital injections. This is because infrastructure projects involve the construction of large-scale, long-lasting structures and systems. These projects require significant amounts of capital to design, build, and operate. Capital investment can be a significant barrier to the development of infrastructure projects, especially in view of the relatively long construction period without recurring income.

- Stable long term cashflow : The strategic significance of infrastructure assets for societies and economies results in an inelastic demand. Infrastructure assets frequently function under long-term contracts and agreements with either government or government agencies, or the private sector via public-private partnerships. For instance, a power plant may hold a power off-take contract with a utility company to supply electricity for 20 to 30 years, providing a consistent revenue stream and predictable cash flows throughout the contract's duration and the lifespan of the asset or project.

- Highly leveraged financial structure : Financiers are often comfortable financing infrastructure projects due to stable firm long-term cashflows, backed by the strategic importance of infrastructure assets. Predictability of the of the cashflow, which reduces risk of default, allows for clearer line of sight of cashflow for investors. The availability of financing also reduces the cost of infrastructure to the asset owners as well as end users, benefiting the overall society.

1 Source: CFA Institute

*** Continue to follow us on LinkedIn @Farosson, for the next topic(s) within this knowledge sharing series ***

Farosson Group Disclaimer

This publication and/or the materials herein prepared are solely for information or educational purposes only and should not be treated as research or advice. This publication may not be published, circulated, reproduced, distributed, transmitted, or otherwise communicated to any other person, in whole or in part, without our express written consent. No guarantee, representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the markets or developments referred to in this publication and/ or the materials herein.

This publication and/ or the materials herein should not be regarded by the recipients as a substitute for the exercise of their own judgement and the recipients should not act on the information contained herein without first independently verifying its contents. Any opinions or estimate expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by others as a result of using different assumptions and criteria. Farosson Pte. Ltd., Farosson Capital Pte. Ltd. and its related companies (collectively known as “Farosson Group”), have not given any consideration to and has not made any investigation of the investment objectives, financial situation or particular needs of the recipient, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient acting on such information or opinion or estimate.

This publication may contain projections, estimates, forecasts, targets, opinions, prospects, results, returns and forward-looking statements ("forward-looking statements") with respect to Farosson Group and its related group of companies future performance, position and financial results. Examples of forward-looking statements include statements made or implied about the Farosson Group's and its related group of companies’ strategy, estimates of sales growth, financial results, cost savings and future developments in its existing business and the Farosson Group's and its related group of companies’ financial position. Statements of future events or conditions in this publication, including projections, sustainability framework plans, sensitivity analyses, expectations, estimates, the development of future technologies, and business plans, are forward-looking statements. Actual future results or conditions, including: demand growth and relative energy mix across sources, economic sections and geographic regions; the impacts of waves of COVID-19; the impact of new technologies; changes in law or government policy, the actions of competitors and customers; including the occurrence and duration of economic recessions; unforeseen technical or operational difficulties; the pace of regional or global recover from the COVID-19 pandemic and actions taken by governments or consumers resulting from the pandemic.

Farosson Group is under no obligation to update or keep current the information contained herein. In no event and under no legal or equitable theory, whether in tort, contract, strict liability or otherwise, shall Farosson Group be liable for any damages, including without limitation direct or indirect, special, punitive, incidental or consequential damages, losses or expenses (including loss of profits) arising in connection with the use of or reliance on the information contained herein, even if notified of the possibility of such damages, losses or expenses.