Published 19th April 2023

There are many benefits when it comes to infrastructure investing as an asset class, and in this episode, we will delve deeper into them as a continuation of our previous knowledge-sharing series.

Infrastructure investment as an asset class has been prevalent globally for decades. Its history can be traced back as early as the 1970s, which has continued to this date.

Leading up to the 2000s, many large-scale privatizations and liberalization initiatives across multiple sectors, amongst others, including telecommunications, rail and roads and energy sectors were established within Europe. The systemic importance of infrastructure assets in ramping up economic growth and societal modernization has made it a key asset class considered by investors worldwide.

The rapidly growing and urbanizing population have increased the demand and the need for new infrastructure, resulting in more investments into this space. Furthermore, existing infrastructures are ageing and now require further capital and investments for enhancement, maintenance, and “green” refurbishment, especially when the world is transitioning to a low-carbon, sustainable economy.

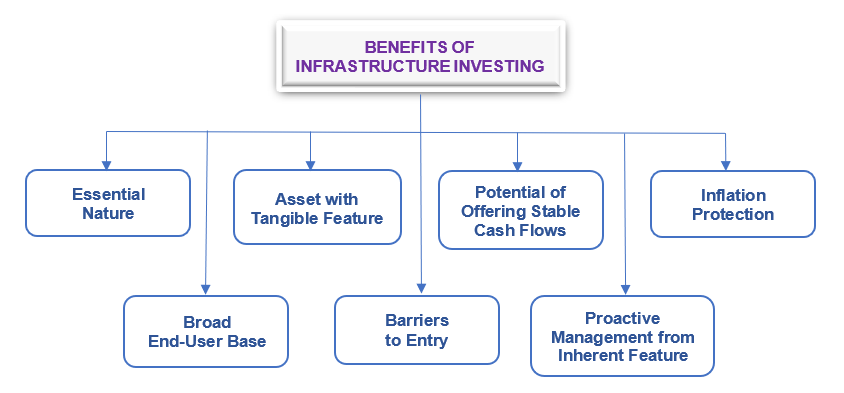

Benefits of Infrastructure Investing

The benefits of infrastructure investing can be classified by the followings, among others:-

1. Resiliency and essential nature to cyclical movements of economy

Given its essential nature, there is a constant demand for infrastructure assets in our economy. Accordingly, infrastructure exhibits lower interconnectedness and correlation with economic cycles, as compared to other classes of assets. Some infrastructure assets, for example water supply, gas pipeline networks and distribution, and electricity are typically regulated. Although their revenue and profitability are predictable, they are less susceptible to economic volatility. Economic cycles could have a higher degree of impact on lesser regulated assets/services, such as ports and airports, though such risk is also mitigated by the essential nature of such assets.

Generally, across different infrastructure assets, the variability of returns could be linked to the strength, transparency and predictability of regulation and contractual obligations of the assets. Against a backdrop of higher market volatility, the reliability and resilience of infrastructure have been an attractive proposition to investors.

2. End-user base is diversified

End-users i.e. the counterparties to infrastructure assets are usually a wide base of diversified communities, which drives stability for the assets’ cash flows. The counterparties base often includes local government bodies / agencies / ministries, giving certainty around creditworthiness.

3. Tangible feature of the assets

The tangible nature of infrastructure allows it to command and retain a residual value.

4. High entry barriers

Infrastructure assets typically require sizeable amount of initial capital investment and expenditure (i.e. during its construction stage) but will only be paid back over a longer term period (i.e. during its operational stage). The initial high levels of capital investment and expenditure serves as a high barrier towards potential new entrants into the market / sector.

In many cases, infrastructure assets benefit from some level of monopolistic positioning. Most times, without a development right, it may even be legally impossible for new entrants to build or duplicate a new plant / facility nearby to compete. Water plants, gas pipelines, power plants and electricity grids are some examples of such monopolistic infrastructure assets.

5. Predictability of long-term cash flow

Long, stable revenue stream and cash flow visibility are core features for infrastructure assets. Infrastructure ownerships are typically held by / transferred to private investors via entering into long-life concession contracts / agreements. Such agreements offer the owners of the assets the right to operate them over a period of time within pre-agreed conditions.

For concessions within monopolistic-styled businesses, for example, electricity or gas distributions platforms / networks, their revenues are typically regulated under long-term concession agreements. Under such fixed contractual obligations, asset managers could implement long-term strategies to enhance and maximize values for the assets. This could be by way of optimizing operational spends / expenditures, putting in place long-term financing etc. In the case of unregulated assets, the depreciating operating life of well-maintained infrastructure assets tends to be long and predictable.

6. Proactive asset management efforts

As aforementioned, infrastructure assets allow owners / managers to undertake strategic proactive management, in order to create value for the investments with the opportunity to enhance returns. Proactive asset management can effectively help boost demand and end-user volumes, and correspondingly, its revenues and incomes. In addition, proactive asset management could help to achieve cost efficiency, capital structure optimization, as well as returns enhancement over and above the course of usual business operations.

Notwithstanding the above, one needs to be mindful that successful value creation is dependent on various factors, including but not limited to, the execution skillsets, experiences, and capabilities of the asset management team. There are also limitations in undertaking such initiatives, particularly for more regulated assets. Generally, the higher the regulatory constraints and protections, there would be a lower operational flexibility to manage efficiency.

7. Inflation protection

Different types of infrastructure assets retain protections / hedge against inflation to a certain degree, given that most of the time, there is contractual opportunity for costs inflation to be passed on to end-users. Most contractual frameworks will usually prescribe for inflation-index adjustment to be borne by the end-users, especially for regulated infrastructure assets. As an example, such frameworks are often witnessed in assets like roads, tunnels and bridges where toll increase will be one of the common features within these concessions. However, such options are less seen for unregulated assets, which are usually negotiated on case-to-case basis.

In summary, infrastructure assets provide stable, long-term returns with relatively low volatility for investors. Historically, infrastructure assets have had lower volatility than other traditional asset classes such as investment into equities and bonds, as it is less exposed to cyclical market sentiment, given its earnings visibility and predictability. Most infrastructure assets offer inflation hedge for investors’ portfolio – hence its returns and value are less impacted by inflation. Furthermore, infrastructure offers diversification benefits while reducing portfolio risk, given the low correlation of infrastructure assets against other asset classes such as equities and bonds.

In summary, infrastructure assets provide stable, long-term returns with relatively low volatility for investors. Historically, infrastructure assets have had lower volatility than other traditional asset classes such as investment into equities and bonds, as it is less exposed to cyclical market sentiment, given its earnings visibility and predictability. Most infrastructure assets offer inflation hedge for investors’ portfolio – hence its returns and value are less impacted by inflation. Furthermore, infrastructure offers diversification benefits while reducing portfolio risk, given the low correlation of infrastructure assets against other asset classes such as equities and bonds.

In today’s world, infrastructure assets play a critical and essential role in promoting the world’s much needed sustainable agenda. Increasing push to address climate change issues through the Carbon Neutral by 2030 and Net Zero 2050 supports the urgency for investments into renewable energy infrastructures. Finally, higher investments are required for “green” refurbishment of existing infrastructure assets to accelerate the world’s transition to a low-carbon economy.

Farosson Group Disclaimer

This publication and/or the materials herein prepared are solely for information or educational purposes only and should not be treated as research or advice. This publication may not be published, circulated, reproduced, distributed, transmitted, or otherwise communicated to any other person, in whole or in part, without our express written consent. No guarantee, representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the markets or developments referred to in this publication and/ or the materials herein.

This publication and/ or the materials herein should not be regarded by the recipients as a substitute for the exercise of their own judgement and the recipients should not act on the information contained herein without first independently verifying its contents. Any opinions or estimate expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by others as a result of using different assumptions and criteria. Farosson Pte. Ltd., Farosson Capital Pte. Ltd. and its related companies (collectively known as “Farosson Group”), have not given any consideration to and has not made any investigation of the investment objectives, financial situation or particular needs of the recipient, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient acting on such information or opinion or estimate.

This publication may contain projections, estimates, forecasts, targets, opinions, prospects, results, returns and forward-looking statements ("forward-looking statements") with respect to Farosson Group and its related group of companies future performance, position and financial results. Examples of forward-looking statements include statements made or implied about the Farosson Group's and its related group of companies’ strategy, estimates of sales growth, financial results, cost savings and future developments in its existing business and the Farosson Group's and its related group of companies’ financial position. Statements of future events or conditions in this publication, including projections, sustainability framework plans, sensitivity analyses, expectations, estimates, the development of future technologies, and business plans, are forward-looking statements. Actual future results or conditions, including: demand growth and relative energy mix across sources, economic sections and geographic regions; the impacts of waves of COVID-19; the impact of new technologies; changes in law or government policy, the actions of competitors and customers; including the occurrence and duration of economic recessions; unforeseen technical or operational difficulties; the pace of regional or global recover from the COVID-19 pandemic and actions taken by governments or consumers resulting from the pandemic.

Farosson Group is under no obligation to update or keep current the information contained herein. In no event and under no legal or equitable theory, whether in tort, contract, strict liability or otherwise, shall Farosson Group be liable for any damages, including without limitation direct or indirect, special, punitive, incidental or consequential damages, losses or expenses (including loss of profits) arising in connection with the use of or reliance on the information contained herein, even if notified of the possibility of such damages, losses or expenses.