Published 23rd June 2023

During Yinson's highly anticipated sYnergy event, an engaging panel discussion titled "Navigating Energy Transition Disruptions" was moderated by Farosson's Chief Executive Officer, Mr Daniel Bong. This dynamic discussion brought together a diverse group of influential experts who are at the forefront of shaping the future of the energy industry.

The Capital Behemoth : Puan Rohaya Mohammad Yusof, the Chief Investment Officer of EPF Malaysia, one of the world’s largest pension funds, has established itself as a prominent player in the field. With her extensive experience, Puan Rohaya brings a wealth of knowledge and expertise to the discussion.

The Investment Maverick : Mr Ash Upadhyaya, Founder and Managing Partner of Cleanhill Partners. Through its visionary approach, Cleanhill Partners identifies promising ventures and accelerates pathways towards achieving decarbonisation and net-zero goals by investing in disruptive and green tech unicorns, fostering their growth and supporting their professional management and scaling endeavors.

The Clean Energy Capitalist: Mr Assaad Razzouk, a Clean Energy Entrepreneur, Influencer, and the Chief Executive Officer of Gurīn Energy. He brings bold ideas for how capital needs to be raised and directed in order for the world to survive the climate crisis.

The Financial Partner: Mr Bruno Le Saint, the Chief Executive Officer of Natixis Corporate & Investment Banking Asia Pacific. Natixis being a progressive financial institution provides extensive support for energy project development through their financing and regulatory expertise.

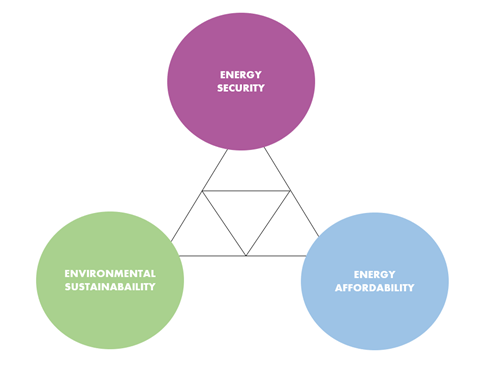

During the captivating panel discussion, the participants delved into the pressing issues surrounding the profitability and affordability of the renewable energy sector. The conversation was prefaced by the recognition of an energy trilemma that the world currently faces – energy security, environmental sustainability, and energy affordability. The panelists acknowledged the impact of high market interest rates on financing decisions made by banks, emphasizing the need for selective investment choices with higher market risk to improve overall portfolio returns.

Additionally, the discussion shed light on the pivotal role that global corporations operating in the renewable space must play in driving energy transition. Participants emphasized the urgency for increased efforts in implementing sustainable practices and strategies. Below, we will delve into the prominent themes and focal points that were explored during the panel discussions.

Energy Transition – What, Why and How

Energy transition refers to the global shift from fossil fuel-based energy to renewable and sustainable sources. It involves deploying renewable energy, improving energy efficiency, electrifying sectors like transportation, modernizing grids, and implementing supportive policies.

The Stone Age did not end for lack of stones - energy transition offers compelling reasons for businesses and industries to embrace renewable energy sources. First and foremost, the availability of better technologies has revolutionized the renewable energy sector. Advancements in solar, wind, and other renewable energy technologies have led to increased efficiency, reliability, and cost-effectiveness. These improvements have made renewable energy more competitive with fossil fuels, encouraging businesses to invest in clean energy solutions. Furthermore, energy storage technologies have addressed concerns about intermittent energy supply, ensuring a stable and reliable power grid.

In addition to technological advancements, the profitability of renewables as a business further drives the energy transition. The declining costs of renewable energy technologies, particularly solar and wind, have significantly improved their financial viability. Lower installation and operational costs, coupled with government incentives and economies of scale, have made renewable energy projects increasingly profitable. Moreover, renewables offer multiple revenue streams beyond electricity sales. Renewable energy certificates and carbon offset markets provide additional sources of income, enhancing the financial returns for renewable energy businesses.

The business case for energy transition is strengthened by long-term cost stability. Renewable energy sources offer predictable and stable costs over the lifespan of the project. By investing in renewables, businesses can mitigate the risks associated with fluctuating fossil fuel prices and secure a reliable and cost-effective energy supply. Furthermore, the growing market demand for clean energy and the preference of consumers, businesses, and governments for sustainable solutions provide a robust market for renewable energy businesses to thrive.

Overall, the combination of better technologies, improved profitability, and long-term cost stability makes energy transition a compelling proposition for businesses. With the advancements in renewable energy technologies, declining costs, diverse revenue streams, regulatory support, and increasing market demand, companies have a strong incentive to embrace renewables as a profitable and sustainable business venture.

Financing Energy Transition

The financing of investments in the energy transition space has seen various approaches and priorities across different regions. Growth investors in developed markets have shown a significant interest in supporting the energy transition through thematic funds. These funds specifically target companies and projects that align with sustainable energy practices. The commitment from investors in this region highlights the growing recognition of the importance of transitioning to cleaner and more renewable sources of energy.

For instance, many companies in Europe have been actively dedicating their efforts to advance the energy transition. These companies understand the long-term benefits of sustainable practices and have been investing in renewable energy projects, energy-efficient technologies, and carbon reduction initiatives. Their commitment not only contributes to the overall goals of the energy transition but also attracts further investments from both local and international sources.

However, when comparing developed markets to emerging markets, it is evident that economic goals often remain the top priority in the latter. These emerging markets face unique challenges and considerations, such as the need for rapid economic growth and poverty alleviation. As a result, the development of the energy transition in these regions might be delayed in comparison to more established markets. It becomes crucial for governments, international organizations, and investors to collaborate and provide support to emerging markets, enabling them to balance economic growth with sustainable energy practices.

From an end-consumer's perspective, accessibility to affordable energy remains a primary concern. While the energy transition is essential for long-term sustainability, consumers also require energy that is accessible and affordable in the short term. Striking a balance between clean energy solutions and affordability becomes a key challenge for policymakers and industry players. It is imperative to develop strategies that ensure the availability of affordable energy options while simultaneously promoting the adoption of renewable sources and energy-efficient technologies.

Overall, the financing of investments in the energy transition space reflects a growing awareness of the need for sustainable energy practices. While developed markets has seen significant progress, emerging markets face unique challenges that require tailored solutions. Balancing economic goals with the energy transition and addressing end-consumer concerns about affordability are crucial factors in driving forward this global transformation towards a cleaner and more sustainable energy future.

Investor Engagement

In the rapidly evolving energy transition space, investor engagement and capital allocation play crucial roles in driving sustainable transformation. Shareholders and board members are increasingly exerting pressure on energy companies to allocate their capital resources toward energy transition efforts. Companies that fail to make this transition risk consigning themselves to irrelevance and ultimately "mining their graveyard."

Recognizing the significance of investor engagement, companies must proactively communicate their energy transition strategies to shareholders and potential investors. This includes clearly articulating how capital will be deployed to capture quality business opportunities in the energy transition space. By demonstrating a concrete commitment to sustainable practices, companies can ensure continued access to capital and foster a positive investment environment.

It is important to note that investor patience and support are often contingent upon a company's execution strategy. Investors seek a comprehensive understanding of a company's vision, strategy, and specific plans for transitioning to cleaner energy sources. To differentiate themselves in the market, companies should identify their unique strengths and focus on further developing and leveraging those areas of expertise. By carving out a niche in the energy transition space, companies can demonstrate their commitment and proficiency in delivering tangible results.

Transparency, trust, and a steadfast commitment to delivery are foundational values that should underpin companies' energy transition strategies. Investors place significant importance on honesty and transparency when evaluating investment opportunities. Companies that prioritize clear and open communication, providing regular updates on progress and challenges, are more likely to gain investors' confidence and secure the necessary capital. Upholding these values helps establish long-term partnerships based on mutual trust, where investors feel comfortable supporting companies that are executing their energy transition strategies in a transparent and accountable manner.

Overall, investor engagement and capital allocation are vital components in driving the energy transition. Companies must proactively engage with shareholders, board members, and potential investors, communicating their energy transition strategies and showcasing their ability to capture quality business opportunities in the evolving market. By focusing on their strengths, being transparent about their progress, and demonstrating a commitment to delivery, companies can foster investor confidence and secure the necessary capital to drive their energy transition efforts successfully.

Lastly, we would like to express our heartfelt gratitude to our esteemed panelists, Puan Rohaya Mohammad Yusof, Mr Ash Upadhyaya, Mr Assaad Razzouk, and Mr Bruno Le Saint, for sharing their valuable perspectives and contributing to the meaningful discussions. Your insights have greatly enriched the sYnergy event. We also extend our sincere thanks to all the participants, partners, sponsors, and supporters who have played an integral role in making this event a resounding success. Your contributions, dedication, and commitment to sustainable practices are vital in driving the energy transition forward.

Together, we are creating a brighter and more sustainable future. Thank you for being part of this important journey.

Farosson Group Disclaimer

This publication and/or the materials herein prepared are solely for information or educational purposes only and should not be treated as research or advice. This publication may not be published, circulated, reproduced, distributed, transmitted, or otherwise communicated to any other person, in whole or in part, without our express written consent. No guarantee, representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the markets or developments referred to in this publication and/ or the materials herein.

This publication and/ or the materials herein should not be regarded by the recipients as a substitute for the exercise of their own judgement and the recipients should not act on the information contained herein without first independently verifying its contents. Any opinions or estimate expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by others as a result of using different assumptions and criteria. Farosson Pte. Ltd., Farosson Capital Pte. Ltd. and its related companies (collectively known as “Farosson Group”), have not given any consideration to and has not made any investigation of the investment objectives, financial situation or particular needs of the recipient, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient acting on such information or opinion or estimate.

This publication may contain projections, estimates, forecasts, targets, opinions, prospects, results, returns and forward-looking statements ("forward-looking statements") with respect to Farosson Group and its related group of companies future performance, position and financial results. Examples of forward-looking statements include statements made or implied about the Farosson Group's and its related group of companies’ strategy, estimates of sales growth, financial results, cost savings and future developments in its existing business and the Farosson Group's and its related group of companies’ financial position. Statements of future events or conditions in this publication, including projections, sustainability framework plans, sensitivity analyses, expectations, estimates, the development of future technologies, and business plans, are forward-looking statements. Actual future results or conditions, including: demand growth and relative energy mix across sources, economic sections and geographic regions; the impacts of waves of COVID-19; the impact of new technologies; changes in law or government policy, the actions of competitors and customers; including the occurrence and duration of economic recessions; unforeseen technical or operational difficulties; the pace of regional or global recover from the COVID-19 pandemic and actions taken by governments or consumers resulting from the pandemic.

Farosson Group is under no obligation to update or keep current the information contained herein. In no event and under no legal or equitable theory, whether in tort, contract, strict liability or otherwise, shall Farosson Group be liable for any damages, including without limitation direct or indirect, special, punitive, incidental or consequential damages, losses or expenses (including loss of profits) arising in connection with the use of or reliance on the information contained herein, even if notified of the possibility of such damages, losses or expenses.