Published 16th August 2023

Welcome to Part II of our Legal and Compliance Series, where we dive deeper on how Farosson manages stakeholders’ interest within the investment management sector while upholding regulatory best practices.

Quality Investment Manager

“Contrary to what most people believe, trust is not some soft, illusive quality that you either have or you don’t; rather, trust is a pragmatic, tangible, actionable asset that you can create.” – STEPHEN M.R. COVEY

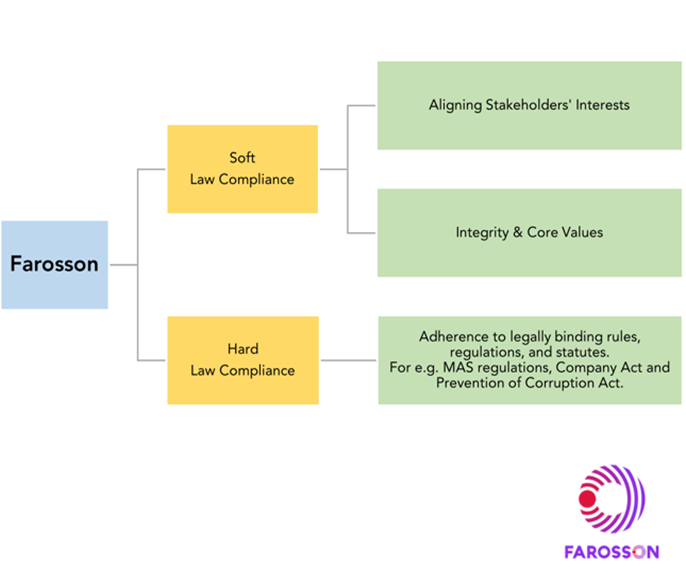

In Part I, we have covered the general overview of conflict-of-interest issues, which are a common topic among investment management/ fund management firms. This could be seen as hard law compliance from a regulatory perspective as it, at times, involves adherence to legally binding rules, regulations, and statutes that investment managers must follow.

On the other hand, soft compliance refers to adhering to non-binding guidelines, industry standards, and best practices. While they may not be legally enforceable, soft law compliance plays a key role in setting ethical benchmarks and guiding behaviour. A quality investment partner appreciates the value of soft law compliance.

At Farosson, we believe that “Trust” is an important principle in soft law compliance which is also one of the core values that we hold in high regard, in addition to being “Bold”, “Agile”, “Collaborative” and making an “Impact”. It is the foundation of a successful brand that presents an opportunity for a long-term quality investment partnership. Trust is not fostered by chance but is built from commitment to the team’s culture, its values and to both soft law and hard law compliances. Building on trust ensures ethical conduct, responsible practices and legal accountability, which we will explore in this article.

Aligning Stakeholders’ Interests:

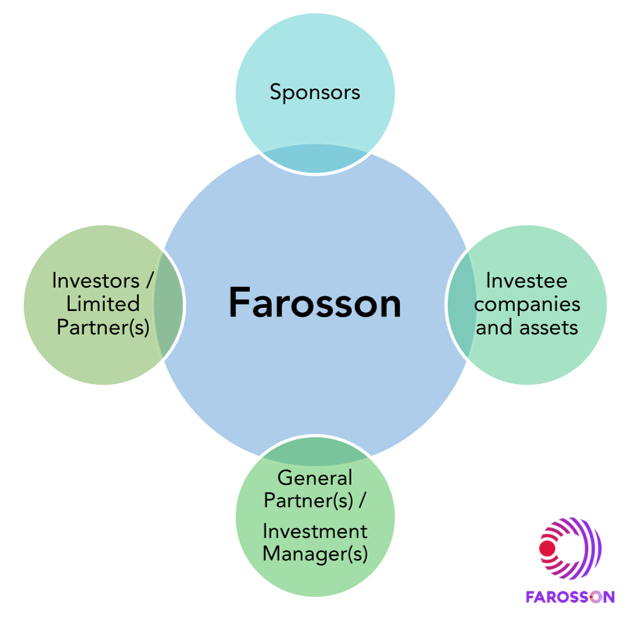

Alignment of stakeholders’ interests and the development of trust are a recipe for long-term success. This is possible through open and effective stakeholder engagements, greatly valued by sound investors, limited partners (LPs), sponsors, investee companies and assets, as well as third-party general partner(s) (GPs)/ investment manager(s).

Unfortunately, investment managers have often been labelled as "vultures," as they are thought to only pocket profits for themselves and their investors. These misconceptions or labels would sometimes cast doubt on the long-term viability of the investment manager’s investing technique and plan.

Investment managers’ fiduciary commitment to its investors / LPs is the foundation of trust and alignment of interests. Positive investment returns will satisfy LPs and will also ensure their continuing support in future fundraising rounds. However, as the business grows, quality investment managers need to continue ensuring transparency and fairness by equally distributing the returns generated. This balanced approach strengthens trust and keeps relationships intact.

“If we have optimism, but we don’t have empathy – then it doesn’t matter how much we master the secrets of science, we’re not really solving problems; we’re just working on puzzles” – Bill Gates

Further to the fiduciary commitment to bring positive returns, it is vital that the investment manager not only brings together like-minded LPs, sponsors and investee companies, but also forms the bridge and link between stakeholders. A quality investment partner would collaborate closely with their sponsors and investee companies to promote openness, transparency, and trust. Teamwork develops mutual understanding, which encourages all parties to confront and overcome any difficulties and challenges together. Stakeholder values are created and enhanced in this trust-building process, paving the way for long-term growth and success.

While time builds trust, things can also south quickly through the erosion of trust, openness and established culture, eventually tarnishing the partnerships’ credibility and hindering any potential for a long-term sustained growth. For instance, when “vultures” or unempathetic investment managers replace the whole management team due to poor performance. Although such wholesale management decision could result in an uplift in results in the shorter term, the management team at Farosson always emphasises the need to invest, operate and manage with empathy. By offering adequate time and support during challenging scenarios, especially post COVID-19, we believe that investee companies can have excellent long-term outcomes only when they have the means and the belief in their potential to recover.

Integrity for Sustainable Growth:

Farosson is committed to conducting business responsibly in compliance with applicable laws and regulations as this is fundamental to protecting the organisation’s reputation and maintaining the trust among our peers and partners. This is achieved through frequent open and consistent stakeholder engagements, and the adoption of policies, principles, and procedures that align with both hard and soft law compliance: -

Code of Conduct and Business Ethics: Provides employees with guidance on resolving ethical dilemmas and fosters integrity in their roles.

Anti-Bribery and Anti-Corruption (ABAC): Sets out the clear expectations and guiding principles for doing the right thing and conducting business ethically.

Whistle-blower mechanisms: Encourages reporting in good faith, providing confidence to employees and others making reports.

Farosson’s Core Values:

Lays down the foundation on how we conduct business and our path in becoming the global investment and advisory powerhouse that partners with you for a sustainable future. At Farosson, we acknowledge the importance of performing well in the vital role of establishing: -

- open lines of communication that fosters “TRUST” and ensuring alignment of interests among all stakeholders;

- an environment where investee companies feel comfortable and open in sharing, so that a “BOLD” and “AGILE” investment manager would be able to synergise or address the challenges and obstacles effectively with all the stakeholders; and

- a “COLLABORATIVE” mindset and empowering investee companies to become “IMPACTFUL” within the sustainable infrastructure sector.

Conclusion

Farosson is committed to building trust with stakeholders by aligning interests, operating with empathy, and conducting business ethically. By striking a harmonious balance between short-term and long-term financial success and nurturing meaningful relationships and compliance, a quality investment manager would be able to create an ecosystem where aligned interests, empathy, opportunity to synergise and the liberty to make informed decisions thrive for all our partners and stakeholders.

Farosson Group Disclaimer

This publication and/or the materials herein prepared are solely for information or educational purposes only and should not be treated as research or advice. This publication may not be published, circulated, reproduced, distributed, transmitted, or otherwise communicated to any other person, in whole or in part, without our express written consent. No guarantee, representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the markets or developments referred to in this publication and/ or the materials herein.

This publication and/ or the materials herein should not be regarded by the recipients as a substitute for the exercise of their own judgement and the recipients should not act on the information contained herein without first independently verifying its contents. Any opinions or estimate expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by others as a result of using different assumptions and criteria. Farosson Pte. Ltd., Farosson Capital Pte. Ltd. and its related companies (collectively known as “Farosson Group”), have not given any consideration to and has not made any investigation of the investment objectives, financial situation or particular needs of the recipient, and accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of the recipient acting on such information or opinion or estimate.

This publication may contain projections, estimates, forecasts, targets, opinions, prospects, results, returns and forward-looking statements ("forward-looking statements") with respect to Farosson Group and its related group of companies future performance, position and financial results. Examples of forward-looking statements include statements made or implied about the Farosson Group's and its related group of companies’ strategy, estimates of sales growth, financial results, cost savings and future developments in its existing business and the Farosson Group's and its related group of companies’ financial position. Statements of future events or conditions in this publication, including projections, sustainability framework plans, sensitivity analyses, expectations, estimates, the development of future technologies, and business plans, are forward-looking statements. Actual future results or conditions, including: demand growth and relative energy mix across sources, economic sections and geographic regions; the impacts of waves of COVID-19; the impact of new technologies; changes in law or government policy, the actions of competitors and customers; including the occurrence and duration of economic recessions; unforeseen technical or operational difficulties; the pace of regional or global recover from the COVID-19 pandemic and actions taken by governments or consumers resulting from the pandemic.

Farosson Group is under no obligation to update or keep current the information contained herein. In no event and under no legal or equitable theory, whether in tort, contract, strict liability or otherwise, shall Farosson Group be liable for any damages, including without limitation direct or indirect, special, punitive, incidental or consequential damages, losses or expenses (including loss of profits) arising in connection with the use of or reliance on the information contained herein, even if notified of the possibility of such damages, losses or expenses.